I Banks on You!

With that statement do you realize lately “Bank” has evolved as a word of trust and dependency? While in English Bank has two different meanings, using “Bank” as a synonym for belief has provided a different dimension to Bank and Banking.

Leaving the unbanked population [sadly that accounts for a third of the world’s adult population] others are still connected to Banks and Banking in some form. Over the last decade, individuals have witnessed an explosion of innovation in Banking – Digital Banking, PSD2, Open API, Mobile Wallets, Mobile Banking, API Banking, and the list could go on and on. So in some way or the other customers “Bank” on Banks, NBFC, and Fintech firms.

For such a trustworthy relationship to maintain, what should Banks plan to make the effort count? Our post of today would explore how Banks can continue building a trustworthy relationship with their customers and customers could say – I bank on you!

Target Focussed Banking aka Neo Banks

Gone are the days when banking products and services were standard and applicable to all. The millennials and Gen Y are looking for personalization and customization. And customization not just at the age level, but also as per their verticals and job role. And this has led to another disruption in Banking termed Neo Bank or Digital-only bank.

Many fintech firms and Big Banks have already launched their offerings as a Neo Bank and customers are using it around the world. As a Bank/NBFC you also need to evaluate the new offering and strategize on how to include it in your plan.

Chances are that you might have already heard about Neo Bank aka Challenger Banks making noise in the Fintech world, but for you to collaborate with a Neo Bank or launch on your own as the offering is dependent on your market research.

Neo Banks focuses on innovation, customer experience [CX], simplified processes, and convenience. The innovation-led banking can see fruitful results by prioritizing customer needs and situation and designing UX and products in a way that make them feel empowered rather than punitive. A combination of modern technology with banking aids in offering personalized services to a fixed set of customers.

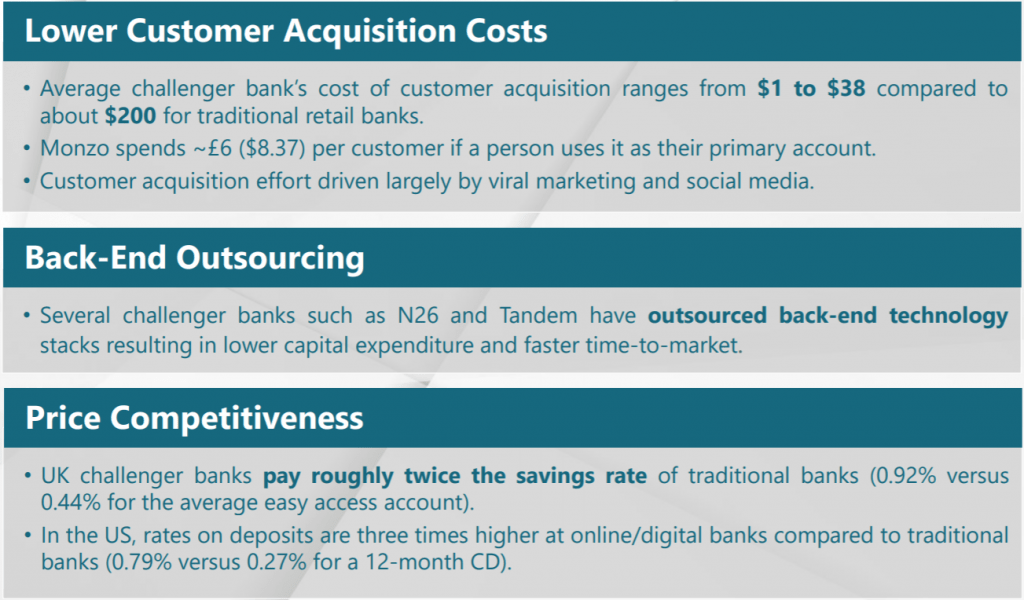

On the operations side, Challenger Banks have to deal with less complex IT systems, low real-estate and distribution cost, streamlined operating models, and most importantly fewer compliance issues when compared to traditional banking, which leads to profitability in banking operations.

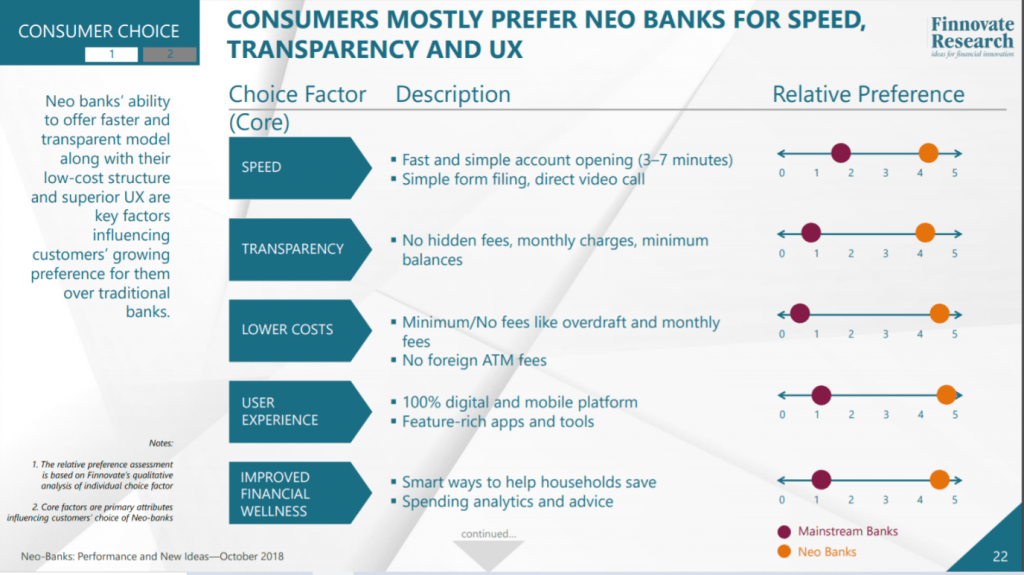

Image – Finovate Research

Talking about the customer choice, as Finovate Research highlights the USP of a neo bank is in the ability to offer a quick and transparent model, that also supports low CAPEX and glorious UX.

Technology is to Help You, Embrace it!

Technology is a helping hand and not to kick you out of your business!

With the technology, you can innovate, discover, transform, revolutionize and design products and services. So much research and papers highlight how technology is assisting in Banking and making Banking accessible to all.

But we still get news from around the world on challenges. Sample these –

Deutsche Bank tech failings hit thousands of payments – CHAPS System a product by Deutsche Bank was in the process of upgrade, but during the audit, it was found that the UK payment system still suffers serious problems leading to around 21,000 payments worth hundreds of millions of pounds being delayed for online shopping company Amazon in recent months

Nearly 50% of banks do not upgrade old IT systems as soon as they should, according to a report by the UK’s Financial Conduct Authority (FCA). And, 43% of US banks still use COBOL, a programming language dating from 1959, a report shows, and extra layers embedded on top of it are causing outages.

Core banking systems often do not run in real-time. This is increasingly limiting as customers demand applications and services built around real-time offerings and capabilities.

So just think about a time in the future say 2023 or 2025, when AI-led Banking or processor that are capable of handling trillions of transactions in a second get accomplished, if you are still figuring to work on mainframes, chances are you may get replaced. So you still have time and solutions in all shapes and sizes, adopt one.

If you are confused, we can certainly help you, we are just a call away to upgrade or integrate with your legacy banking system.

Yes, Data is the New Oil but are you Using it?

With the entry of 5G into the arena, expect data to travel at the highest speed, can support large volume and variety, backing all three v’s of the data. But once you have the data, how efficiently do you use it? Research indicates that Bank has the highest number of files of data that are left unused.

80% of data is generally considered unstructured data and is left unused for decision-making. – As per a 2018 report.

So let us plan in 2020 to use that data in ‘n’ number of ways discovered and other ‘no’ numbers that you can explore yourself. Some of the following use cases you can start with –

- Customized Services based on Spending Data – With a Salary account with Banks, it is easy to analyze where do they spend? How much amount goes into utility bills, shopping fuel, or even school fees. You can also analyze if over time the spending is increased and in which area? Depending upon the major areas a bank can offer customized services like tie-ups with e-commerce brands during the festive season to avail cashback or customize insurance cover with exhaustive cover.

- Group based on Spending Habits – Another data point that could assist bankers is a grouping based on spending habits that say some people prefer to put into Capital markets, while others usually spend on travel. So you cannot offer travel insurance to the latter group of individuals. Or clubbing a flight+hotel offer would make more sense to individuals who travel a lot and the holiday season is approaching. However, you can win the interest of people’s inequities with a report predicting the upcoming trends in a particular region.

- A precursor to Fraud – If the individual has been spending in home currency and suddenly a transaction is made in another currency, it needs validation if it’s the owner of the card or the card has been stolen. Even sudden withdrawals by a person’s card when he usually goes cashless could signal a crime. Such cases would need validation and would help gain customer trust.

Make Security Your Prime Concern

In UK Over 12,000 customer complaints about financial fraud were lodged with the ombudsman in 2018/2019, an increase of 40 percent from the previous year.

As per the report from RBI – Banks reported a total fraud of Rs 71,543 crore in 2018-19, a 74 percent increase as against Rs 41,167 crore in the previous financial year in India

Do you see the data, on how active fraudsters and scamsters are now? They are ahead of us and it is your effort to help your customer not get trapped. As customers may lose their money you would lose your brand value. So take steps in adding layers of security like –

- Multi-Factor Authentication

- Monitor transactions, use AI/ML-based algorithms to analyze logs, login addresses, and alert in case an unknown activity is diagnosed.

- Do you reconcile on daily basis? As it would help in keeping the accounts balanced and in case a tricky transaction happened, it can be caught earlier.

- It is layering Funds Transfer and Payments with a multi-control and multi-alert system. As you add a person to make the payment on the Digital channel, add SMS/email or even a phone call alert to confirm if it is done by the owner. And even the fund’s transfer could be approved by two people to stay safe better than sorry.

- Educate, make the customer aware of How to be safe, and keep financial information away from online scamsters.

Not banking/Open Banking is a “Must” in the 2020 Plan

Bluetooth Sunglasses/Speaker with your phone, phone with your laptop, laptop with your 64” LED TV, TV talking to Alexa and Alexa commanding the ACs and lights of the house.

Welcome to the world of connected devices!

With so much connectivity, how can you not include Banking via these devices? You might have built APIs to integrate with the Money Management app or Design an Insurance plan, but the customer needs that same experience via all devices. Are you set for that?

If not, start thinking about how your Banking App would work with Alexa? Or if a smart refrigerator is launched your banking app can connect to grocery stores and pay for the weekly groceries.

All of this is an enhancement to Open API Banking, so if you haven’t still planned to launch your API we can surely help you with that. Just contact us here.

Green Banking can Place you in the Limelight

In case you are not aware of “Green Banking” then it’s a term to promote environmental-friendly practices thereby reducing carbon footprints from banking activities. While adopting e-statements, no receipts, and cashless funds transfer are some of the responsibilities of customers, you as a bank can equally contribute and flash it to attract business.

Banks can come up with

- Lower interest rates for business projects that are considered environment-friendly and help in nurturing the environment.

- Offering Green Credit Cards that are made of biodegradable material rather than plastic to help the environment

- Save on Commute, go digital with online and mobile banking can help in reducing fuel consumption

So what are your plans for 2020? Yes, Banking is getting complex but with the right strategy, vision, and tools you can still deliver a seamless banking experience to your customer. If you have questions on technology or banking or the trends, we can help you sail through. Just contact us here.