The owner of Narayan Enterprise – Venkat Narayan Giri was looking at the ledgers, the account reconciliations accounting team had highlighted a mismatch of 2,34,192.43 INR. It was a month’s end task and usually, a mismatch of 10,000 – 25,000 INR was usual, but this time the sum was huge and the accounting team has matched every record almost 4 times, but yet the “missing” entry was not found.

Since last week, the accounting team had been staying late till midnight to complete the month-end task, and apart from the worry they were really looking tired. Managing multiple ERPs, invoices, bank accounts, payment collection via Digital and cash mode – it was a humongous task!

Does the tale resonate with your team/business?

Account Reconciliations and Accounting Team

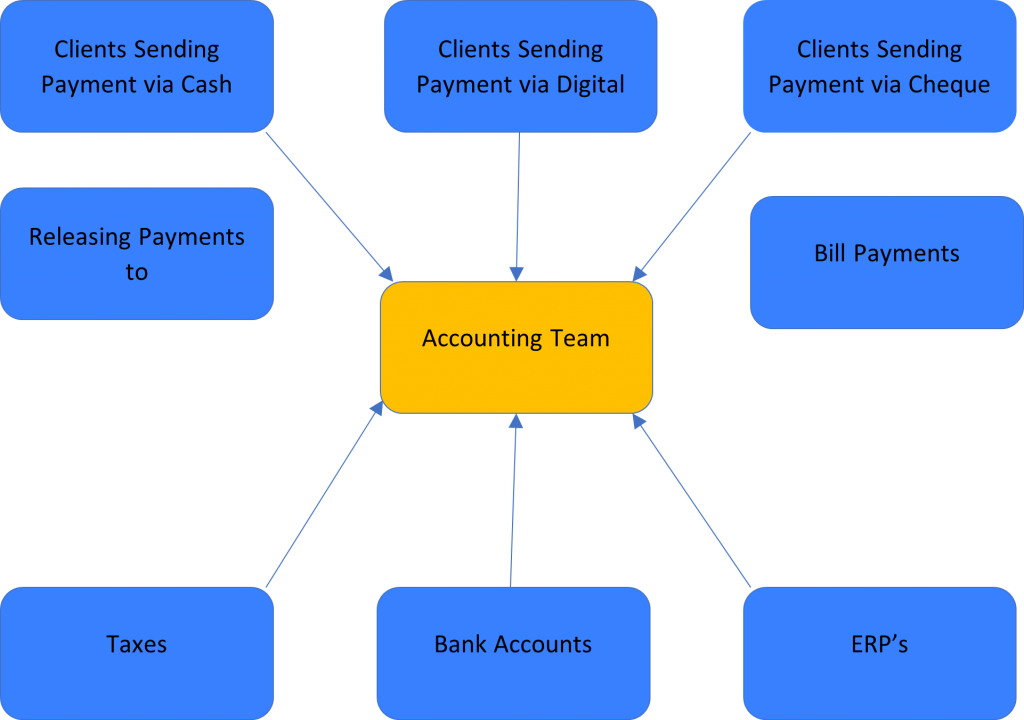

Account reconciliations are not an easy job for the accounting team. The below diagram shows how much data is fed to the books on a daily basis and needs to be reconciled by end of the day/month.

That’s why a full automated reconciliation process is of utmost importance, while automated reconciliation in excel can help, opting for a platform that not only connects to the ERP’s and banks but also takes care of the cash and digital payments of invoices is crucial.

How do you automated account reconciliation process and can business achieve full automation?

Reconciling an invoice. We are here to help.

No matter which vertical you belong to – Manufacturing, Retail, Pharmaceutical, Distribution or Construction you would be using the following steps to run a business –

- Using one or multiple ERP’s or Accounting Software for automation of various processes.

- If you are running multiple businesses/offering different services even the business bank account can differ and so does the payments.

- Use of a HR Payroll system or a different ERP to manage your team salary and reimbursements

- Using a Tax management system to take care of taxes

- Agent Collection Team for Cash Collection

- Using other bank accounts for debt payments or EMI’s

If you are able to automate each of the above steps FULLY AUTOMATED RECONCILIATION can be achieved.

Hylobiz can assist you in achieving full automated reconciliation.

Click here to know-how

Handling ERP’s for Reconciliation

The birth of ERPs was done to automate the manual process of accounting, business processes but with so many options available cross-linking of ERPs was never thought of.

Hylobiz understands the pain points of businesses and offers integration of ERPs like Quickbook, Zoho. Tally, Marg, etc. that means whether you create your invoice on Zoho or Tally or on the Hylobiz platform, the details would flow back to ERP’s or Hylobiz and Hylobiz Dashboard would always show you the real-time updates about your balances.

For example, if you are using Tally as dictated by the manufacturer and for your business, you found Quickbook handy and reliable, once you have onboarded on Hylobiz and integrated with both the ERP’s, any invoice payment is done on Tally would flow back to Hylobiz and any salary disposed of via Quickbook would update the Hylobiz Dashboard in real-time i.e. achieving reconciliation in real-time, no need to export and sync the records by EOD.

Hylobiz Tally integration is now more powerful. Check the details here

Handling Multiple Bank Accounts for Reconciliation

Running multiple businesses with different bank account reconciliations or multiple bank accounts to manage liquidity? Hylobiz integration with all the bank accounts can help you in getting reconciliation done in real-time.

So if Bank Account 1 just got debited with an EMI to be paid for the Office space and Bank account 2 just received payment of an invoice, the Hylobiz dashboard would reflect the changes instantaneously.

HR Payroll System or Tax Management Platform

With an API you can integrate your payroll and tax management system with Hylobiz, that is a brownie point as unless you know the debits/payments due you would never be able to come up with the revenue your business is able to generate.

The real-time Dashboard update also helps to keep enough cash in hand for the upcoming dues in a month avoiding you being a defaulter anytime, thereby keeping a check on your credit score and opening possibilities of expanding businesses with business loans.

Cash Collection and Cash Payments

Cash Payments and collection is the biggest loophole in getting the account reconciliations cycle automated completely. But Hylobiz has come up with digitizing these collections as well, by helping the agent collections team to be tracked in real-time.

Once you initiate the request of tracking a cash collection request, you would get real-time updates of where the collection agent is and whether the collection made has been partial/full, and also the ETA of the agent.

Once the agent lands at the destination, the tracking gets completed and the accounting team can make the payment status as completed in real-time.

Reconciliation is quick and easy, and 100% automated. Register here or contact us here to know more

Automated Reconciliation is the process of improving business processes and eliminating manual errors. Each tool offers its benefits, but the USP is here is communication among those business tools and Hylobiz helps in achieving that at each level.

Do check out our video on how Fully Automated Reconciliation is possible for all businesses with Hylobiz