Shortage of liquid funds in business?

Your cash is arrested in outstanding invoices?

Businesses of multiple sizes across multiple industries function in the global market and contribute to the global economy. Businesses, especially the MSME businesses, often find it difficult to manage the balance of cash flow resulting in working capital impairment and poor business vitality. The unavailability of adequate funds is a noose and can be a serious roadblock for business growth. This can be appropriately handled by a concept popularly known as invoice discounting or bill discounting.

This article might help you in understanding what invoice discounting is and how you can make use of the process to get financed and have enough funds to manage operational expenses.

Invoice Discounting defined

A business while selling products or services to wholesalers, distributors or other significantly large clients often raise invoices on credit which can be paid by the purchaser on a later date mentioned on the invoices. Considering the strong competition in the market, businesses often agree to a due date which can range between 1-6 months. A longer credit cycle creates a shortage of cash inflow and the invoices raised for sales made in credit often do not get paid on time.

Invoice discounting or bill discounting is an invoice financing process that can effectively be used by businesses to get access to short-term funds and is opted as a substitute for a business loan.

In the invoice discounting process, a business borrows a loan from financial institutions against the unpaid invoices/bills. It is a short-term borrowing available from lending institutions. This helps the business liquidate funds to manage expenses.

Why invoice discounting?

- Better working capital

- Help control current liabilities

- Easy access to more credit amount

- Liquid fund available for the purchase of supplies and goods and for repayment of business loans

- Stronger business relations

- No additional collateral is required

- No need for chases for invoices

- Quick and steady cash flow

- Suitable for the businesess of all industries

- Get access to more profit

Factors determining invoice discounting

- Amount of funds required

- Active client base

- Total amount outstanding in the unpaid invoices

- The goodwill of the business and the turnover it has

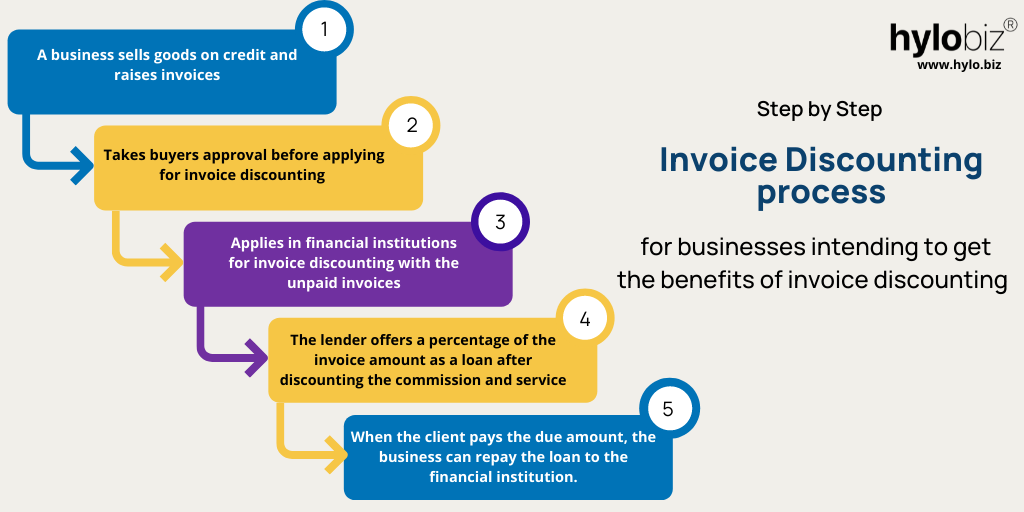

Invoice discounting process

A business sells goods on credit and raises invoices/bills/account–> Takes buyer’s approval before applying for invoice discounting–> Applies in financial institutions for invoice discounting with the unpaid invoices–> The lender offers a percentage of the invoice amount as a loan after discounting the commission and service charges (called the discounting fees)–> Finally when the client(the business who is the purchaser) pays the due amount, the business can repay the loan to the financial institution.

Fintech firms can help access finance by invoice discounting

MSMEs have a huge credit gap due to insufficient assets to pledge as collateral for loans and minimum revenue. Again, the information asymmetry of SME businesses creates hindrances in accessing invoice discounting facilities, and fintech companies come to their rescue by collating the transactions. (https://economictimes.indiatimes.com/small-biz/sme-sector/fintech-solutions-to-small-business-credit-woes/articleshow/82307737.cms)

Suggested read:https://medium.com/@hylobiz/how-is-fintech-determining-the-future-of-the-financial-sector-bd10f82ff074

Hylobiz is a secured fintech and a promising neo bank supporting businesses to digitize their transactions and track their receivables and payables, payments, and collections. The platform caters to the B2B segment and plays a strong role in supply chain financing. Hylobiz is partnered with leading banks and NBFCs and is pre-integrated with top ERPs. Remain updated about our latest posts. Follow us on medium: https://medium.com/@hylobiz

Learn about Hylobiz partners: https://hylo.biz/partnerships-update-post-hylobiz-speaks-about-the-products-offered-by-bank-nbfc-partners-and-an-offer-to-collaborate/

Visit to find what Hylobiz offers to SME businesses: https://hylo.biz/offerings-sme/

Facilities on Hylobiz that can help avail of invoice discounting facilities

- Easy ERP and account integration

- Create/ upload and send proforma, sales, and final invoices via multiple communication channels

- Automated reconciliations on real-time

- Digital and quick onboarding

- Technical support

- Easy access to working capital

- Cash flow visibility

- Accounts receivable management and access to the status of invoices in realtime

- Access to the online digital ledger

- Real-time dashboard

- Business health score

Hylobiz can help your financial details and transactions track well. The tracking of unpaid invoices helps you get access to credits through invoice discounting. Want to connect? Contact us

Digitization of invoice discounting can enable easy credit for every business. V Tap is a feature that enables financial institutions to support ecosystem financing.

Check out V Tap or Vayana Tap on the Vayana Network website.

Read more on Hylobiz features: https://hylo.biz/grow-with-hylobiz/.

Read Hylobiz blogs on https://hylo.biz/blogs/

Other Hylobiz highlights

- ISO certified platform offering data encryption and 2-factor authentication

- Certified by Visa International

- Free subscription for a lifetime and free installation. Sign up for free and Book a demo

- Low transaction charges

- Automated reminders

- Digital collections through payment links

- Digital payouts

- User-friendly APIs

- Business loans through partner banks like Bajaj finance and Neogrowth Credit Pvt Ltd

Avail business loans from Bajaj Finservà https://bit.ly/bajajfinservbusinessloans

- Connected banking facilities and Pre-approved SME credit cards by partner banks

Suggested read

– to learn about pre-approved credit: https://bit.ly/PreApprovedCreditCardsForBusiness

-to learn about collateral-free SME loans: https://bit.ly/loanwithoutcollateralsecurity

-on things to know before applying for a business loan: https://bit.ly/35flzYQ

Let your business get access to automation and finance with Hylobiz. Reach us at: support@hylo.biz