Joseph, a small business owner based out of Bengaluru was in trouble paying off his shop rent, electricity bills, and other day-to-day expense as he was not able to manage his inventory, receivables, and cash.

Here the problem faced by Joseph is the inefficiency to manage working capital. In the same way, it is important for every business to give importance to working capital management to keep a check on their profitability and growth.

What is working capital?

Working capital management is a financial tool that measures the operational efficiency and short-term liquidity of a business. It measures the ability of a business to pay off its current liabilities out of its current assets.

Types of working capital

1. Gross working capital: It is the sum total of Current assets held with an enterprise.

Gross working capital = Current assets

2. Net working capital: Net working capital is the difference between current assets and current liabilities of an enterprise.

Networking capital = Current assets – Current liabilities

To calculate working capital we need both current assets and current liabilities, where current assets comprise inventory, prepaid expenses, account receivables, cash at the bank and current liabilities comprise account payables, outstanding expenses, and other short-term liabilities.

Now let us discuss how technology and automation can help SMEs in optimizing working capital management

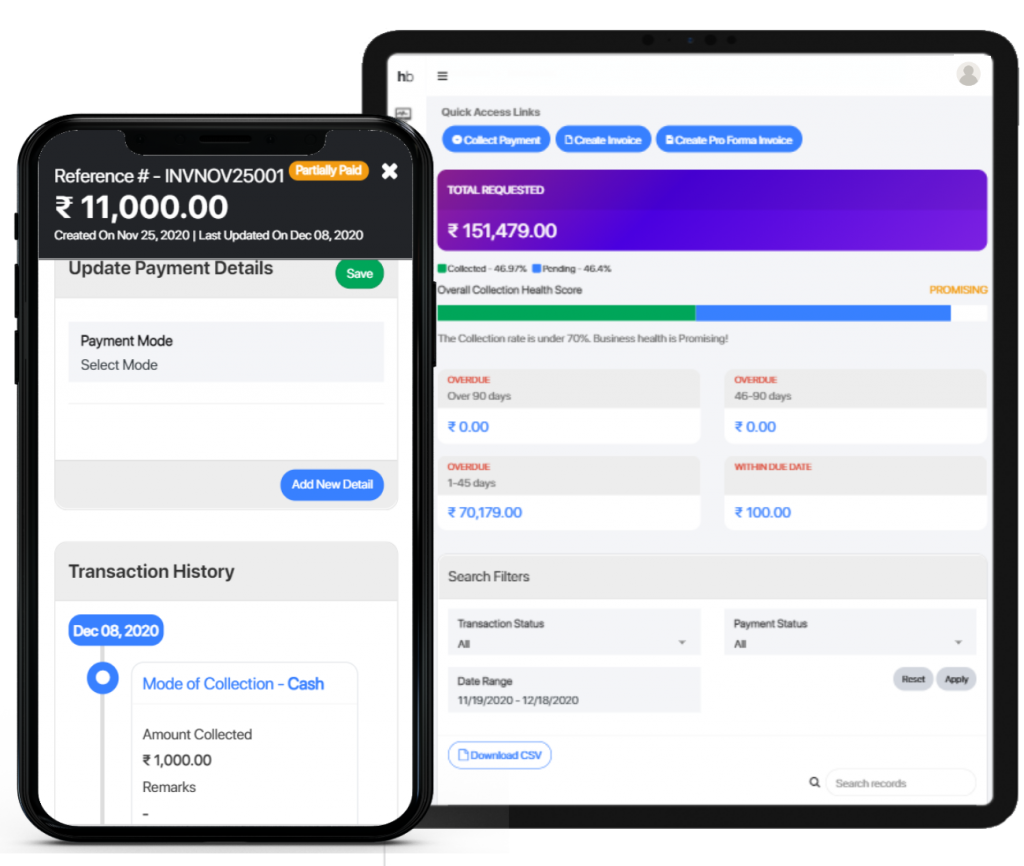

1. Automate account receivables and account payables

Streamlining your account receivable process not only helps in managing working capital well but also helps in cutting down costs and employees’ time.

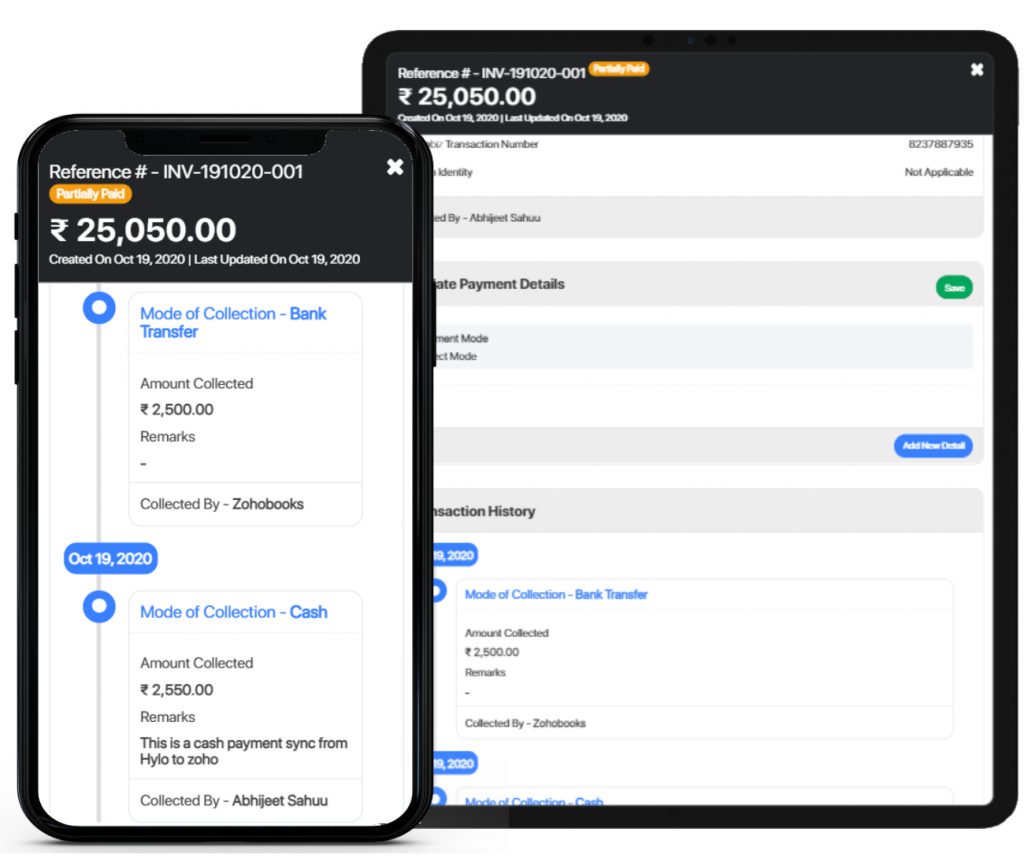

Businesses enjoy higher liquidity by automating their account receivable. Also, they can track their real-time inflows with ease.

Automation ramps up the collection process by shortening the debtor’s collection period with timely payments and by sending automated reminders.

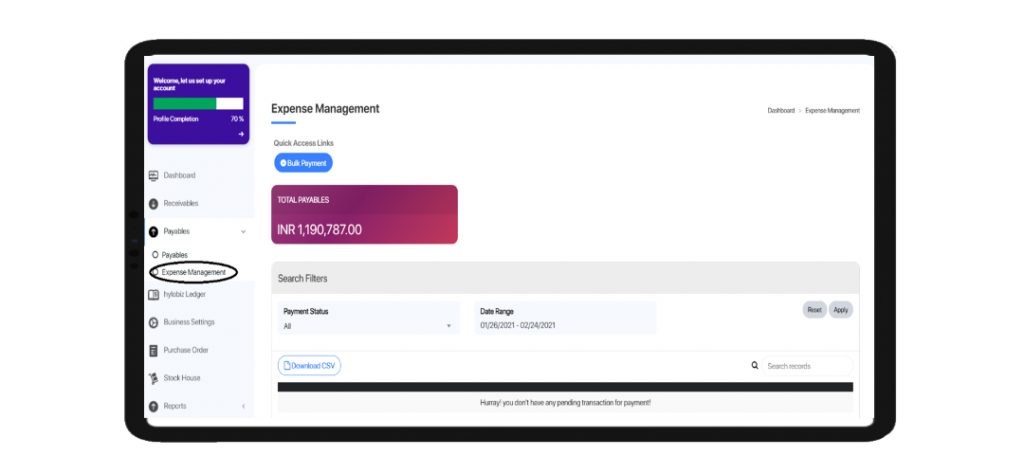

Automating account payable also plays a vital role in working capital management as it scans the invoices electronically and eliminates errors in the invoices.

It provides greater visibility and transparency to management which helps them in better decision making as well.

Automation manages invoice payments on time and thus provides a better liquidity position.

Automate Invoicing

choose automatic Invoicing by integrating with your existing ERP, which also helps businesses in getting paid faster and hence contributing to an increase in inflows.

E-invoicing helps in getting better visibility on payables and receivables along with speed and reliability.

Also, electronic invoices are easy to reconcile and hence provide more accurate working capital management.

3. Inventory management

With the automation in inventory management, an organization can analyze better the slow-moving or fast-moving inventories, which will help in stock refiling.

As in maintaining inventory funds are used and provide lower liquidity unless the inventory is not sold and converted into cash.

So, unnecessary hoarding of inventory is also bad for an organization, also results in inventory storage costs.

The inventory turnover ratio should be lower to enjoy higher liquidity.

4. Digital Transformation

Digital transformation can help businesses in many ways be its inventory management, receivables collection, payables management, automated invoicing, and connected banking as well.

With the help of technology, businesses can easily forecast their targeted sales, raw materials quantity to be purchased, estimation of networking capital required.

Also, they can get real-time insights on their spending and slow-moving inventories. with this, they can analyze their unnecessary expenses and strategise their cost-cutting and cost reduction techniques.

Integration with the connected banking helps businesses in reducing the operating cycles and also they do not lose in terms of interest and processing costs.

Businesses came to know better about their fixed and variable cost and try cutting them and with all this automation and technology they enjoy a positive cash flow and better efficiency in working capital management.

5. Shorter operating cycle

Operating cycle is the time right from purchasing raw materials to receiving cash from customers.

Shorter the operating cycle, better the liquidity. Operating cycle is denoted in number of days.

Operating cycle can be also called the cash conversion cycle.

it can be calculated as follows :

operating cycle = Inventory holding period + Receivables collection period – credit period allowed by suppliers

Digitisation helps in improving the operating cycle as it improves better inventory management , minimises cash conversion cycle and also automates payables.

With a shorter operating cycle a business enjoys better working capital management.

6. Negotiate Payment terms and Debt rates

Automation helps you in getting paid faster from clients and also you can analyse your defaulting clients. Try setting better payment terms and also set a fixed credit period. Also penalise for late payments

With the help of automation choose your supplier wisely and also negotiate longer credit period with your supplier , this will help in shortening operating cycle and hence there will be more liquidity.

Also consider replacing your short term debts with long term debts, Repay your high interest debts and also consider choosing debts with lower interest rates.

Hylobiz has also partnered with some Fintechs and NBFCs such as Bajaj finance , Neogrowth to provide loans, working capital financing and invoice discounting on its platform.

Hylobiz offers connected banking services that integrate with your existing ERPs , automates receivables ,payables and send automatic payment reminders along with reconciliation and invoice collection.

Reach us at : support@hylo.biz