In the modern world, a business’s consistent cash flow is essential. It ensures the business’s expansion, growth and operations.

Your business can plan for inventory and make vendor payments more dependably the quicker you can collect on invoices. Faster invoice collections are necessary for a business to run smoothly.

What Happens if Invoice Collections are Delayed?

Delayed invoice collection can raise your operational expenditures and divert effective time that could be used to boost cash flow and collections. Payment delays can harm business relationships and impede business operations.

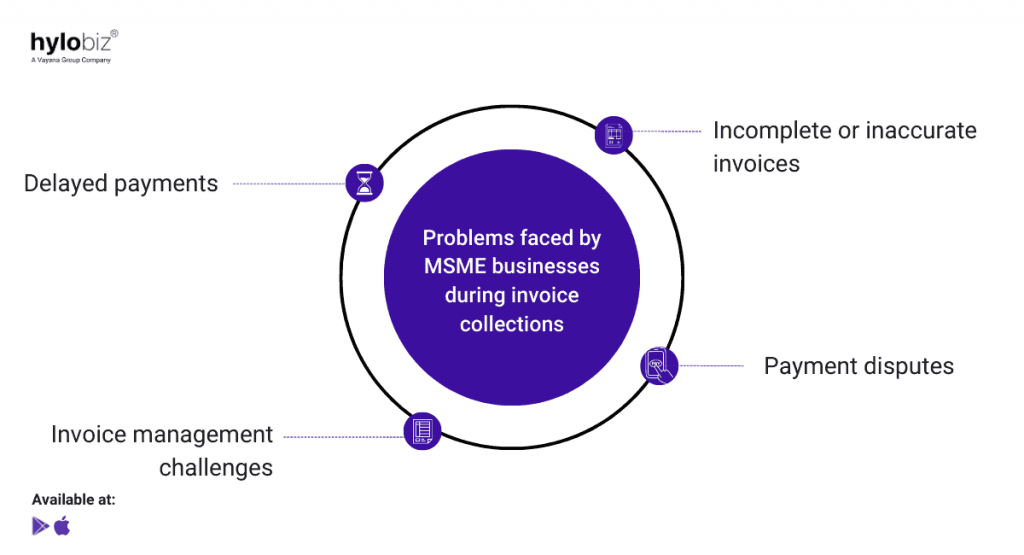

What are the Problems Faced by MSME Businesses during Invoice Collections?

Delayed Payments

There are customers who don’t pay on time. This can cause problems with cash flow and possibly financial challenges.

Incomplete or Inaccurate Invoices

Businesses may have issues with incomplete or inaccurate invoices. Payment delays or customer disputes may result from errors in the invoice, such as improper billing amounts or inaccurate item descriptions.

Payment Disputes

Payment disputes can occur when consumers contest the accuracy of the invoice or decline to pay for a variety of reasons. Legal battles may result from this.

Invoice Management Challenges

Managing invoices can be difficult for companies as It can take a lot of effort and result in administrative difficulties to keep track of payments, remind people to pay, and handle disputes.

Benefits of Faster Invoice Collections for B2B Businesses.

Increased Cash Flow

When invoices are collected more rapidly, businesses receive payments more promptly, boosting cash flow and allowing them to invest in their operations, pay their obligations on time, and seek new possibilities.

Lower Administrative Expenses

By collecting bills more quickly, firms can save the administrative costs of chasing delayed payments.

Better Customer Relations

Companies who collect payments on time retain positive connections with their clients, increasing the likelihood that those clients would do business with them again.

Increased Efficiency

While less time and money are spent managing unpaid bills, invoice collections automation can help boost efficiency within a company.

Better Forecasting and Planning

Faster invoice collection allows firms to better estimate their cash flow and prepare for future costs, expenditures, and expansion prospects.

What are the Benefits of GST e-invoice?

E-invoicing refers to electronic invoices. However, in India e-invoice is not just an invoice but a type of invoice that includes the tax GST.

Until the government of India introduced GST e-invoicing, failure to receive payments on time was a major problem faced by businesses.

- E-invoicing helps reduce errors and compliance issues, as it eliminates manual data entry and ensures that the invoice details are accurate and in line with GST regulations.

- E-invoicing ensures faster processing of invoices.

- E-invoicing improves cash flow.

- E-invoice saves cost as the payment from businesses are done on time and thus ensures enhancement and growth of the business.

How to Achieve Faster Invoice Collection for your business?

- Introduce automation in invoice management

- Send out timely reminders

- Keep your payment period short

Guess what? All these can be done perfectly with Hylobiz- a fintech platform that allows you to generate sales and e-invoices effectively.

Why Hylobiz for Faster Invoice Collection?

Digitize your collections without changing your processes by linking your existing ERP and bank account with the platform. Hylobiz automates the billing and payment process, enabling faster sending and processing of invoices. This may shorten the time it takes for a company to get paid for its goods or services.

Customised Payment Reminders

Sending payment reminders through SMS, WhatsApp, or email will make collecting money easier. Make up your own rules to manage the duration, stage, and frequency of reminders and nudge your customers for faster collections.

Business Reports and Dashboards

Track unpaid invoices/bills, transactions and cash flow in real-time to collect payments faster and get access to easy working capital.

Payment Links and QR Codes

MSME businesses can send out payment links and QR codes to their business clients and can get paid on time.

For B2B businesses, quicker invoice collection is essential. It makes it possible for businesses to effectively manage their cash flow, boost their income, cut their administrative expenses, preserve solid client connections, and raise their credit scores. B2B companies may position themselves for long-term success and sustainability in today’s cutthroat business market by putting in place effective invoice collection methods.

Having a place with automatic payment reminders to go to is all that you need!

Sign up now on Hylobiz for faster invoice collections and improve your cash flow.

Read our blogs: https://hylo.biz/blogs/

Book a demo: https://hylo.biz/book-demo/

Reach us: support@hylobiz.com

Frequently Asked Questions (FAQs)

How can I improve my invoice collections?

To improve invoice collections, setting clear payment terms should be the first step you do. Stay transparent about your payment terms, including the due date and any late payment fees. Send timely payment reminders. Automated reminders can save time and ensure consistency. Make it easy to pay by offering a variety of payment options, such as credit card, PayPal, or bank transfer. Consider adding a payment link or QR code to your invoices.

What is the B2B invoice collection process?

The B2B invoice collection process starts with sending an invoice to the client, which should include information like the invoice number, due date, payment conditions etc. The payment due date should be clearly stated, and a polite payment reminder should be sent to remind the consumer of their duty to pay. When the money is received, escalation and payment receipts should be sent, and both payments should be recorded and validated with the client.

What is the difference between B2B and B2C invoice collections?

1. B2B collections include collecting money from other businesses, whereas B2C collections involve collecting money from individual customers.

2. Payment terms for B2B invoices are often 30, 60, or even 90 days, but payment terms for B2C bills are normally 7 or 14 days.

3. Since B2B businesses have bigger client bases and higher transaction volumes, they often issue more invoices than B2C businesses.

4. The strategy for collections may differ between B2B and B2C collections.

5. B2C collections may entail more personal communication, such as phone calls or emails to remind customers of their payment obligations.

How can invoice collection automation helps a business to succeed?

1. Faster Payments: With automated invoicing, businesses can send invoices quickly and accurately, resulting in quicker customer payments.

2. Time Savings: By automating the invoice collection process, businesses can save significant amounts of time, allowing employees to focus on more important tasks.

3. Reduced errors: Invoice automation can help to reduce errors by ensuring that invoices are accurate and up to date.

4. Cost Savings: By automating the invoicing process, businesses can save money on administrative costs such as manual billing and follow-up.