Fintech has disrupted the financial services industry with the use of technology. Fintech innovations have transformed many subsegments like retail payments, business banking, insurance, and wealth management services. As we all know, lending being one of the segments, has seen a transformation like never before.

The reasons that led to this change are :

⦁ Advancement in technology

⦁ Building better customer experience

Due to the problems faced by businesses in lending from traditional institutions, digital lending is gaining traction from the consumers and reducing the financial gap.

Connected banking and connected ERPs are driving digital lending rides in many ways. Also, it is beneficial for both banks and consumers.

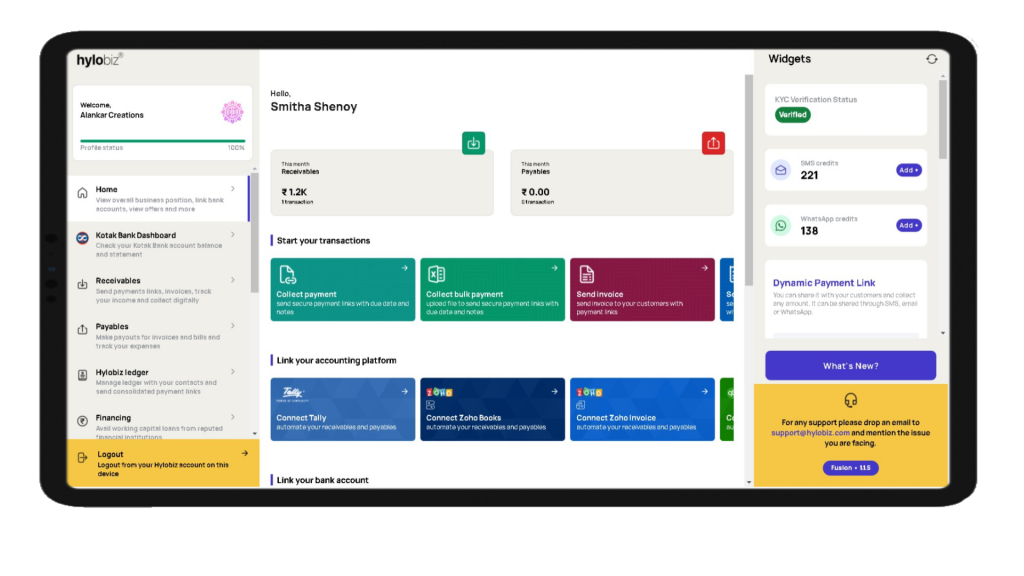

Hylobiz offers connected banking and ERP services to businesses that help in automating collections and payables. It improves collection efficiency by offering various payment modes and automated payment reminders. Also, it helps to automate your invoicing and gives access to a dashboard with business reports that helps in decision making.

Hylobiz offers easy and quick business loans, working capital loans, and invoice discounting services. Also, avail of SME credit cards to boost your working capital.

Now let us discuss how fintech is improving the business lending system?

Smarter lending

By integrating ERP on the Hylobiz and connecting your bank account, getting access to capital has become easy. It helps businesses with real-time dashboards and reconciliation that helps in building their creditworthiness. Also, they gain access to easy and quick loans at cheaper rates.

It has resulted in easy processing, quick disbursal, and low cost, ultimately which improves customer experience.

Seamless process

Digital lending has seen high traction with the help of connected banking and ERP. ERPs have improved the bank lending process and decision making it gives access to a business’s data and transaction history.

Also, it has been easier for businesses to build their credit history with the help of connected banking and ERP. Even the process has become paperless as a business need not fill in any data as all the data are pre-filled from ERP. It also makes the loan process seamless and transparent.

Better loan management

It becomes easy for both the banks and consumers to manage the loan with the help of connected ERPs. Through APIs, customers can authorize repayments directly from their bank account, saving them from missing any due date. Also, that results in faster collection for banks and savings in collection costs.

Churning the data

By leveraging data and analytics, banks can gather so much data from the customer’s transaction, spending pattern, and financial behavior that helps banks to develop new products and revenue models. It has also helped banks in bringing down the cost.

All this data mining has led to the birth of many new lending products in the market, named BNPL, Secured credit card, cash-flow-based lending, revenue financing, etc.

Read more on benefits of business loan: https://bit.ly/businessloansbenefits

How is Hylobiz helping the businesses?

1. Existing Kotak Bank and YES Bank customers can connect their existing bank accounts on our platform to enjoy hassle-free connected banking services.

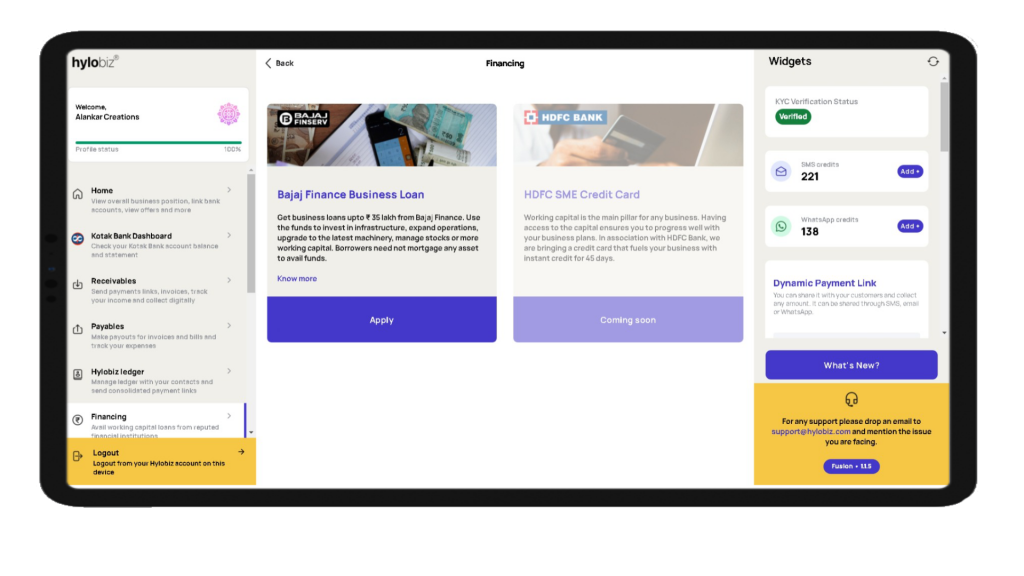

2. Our financing feature allows businesses to:

Get easy and quick access to business loans from our partners such as Bajaj Finserv and Neogrowth credit private limited.

Avail invoice discounting services

Get an SME credit card and enjoy up to 50 days interest-free credit period

Read more on how to get a pre-approved credit card: https://hylo.biz/hylobiz-how-to-get-pre-approved-credit-cards-for-businesses/

Read more on invoice discounting: https://hylo.biz/hylobiz-what-is-invoice-discounting/

To simplify businesses and help them grow, we’re soon launching many more products in partnership with banks and NBFCs.

Ways in which Hylobiz helps small and medium businesses are :

⦁ Digitizing their receivables and payables

⦁ Automating their payables and collection

⦁ Auto-sync invoices from any ERP

⦁ Get your invoices paid faster

⦁ Improves your collection efficiency

⦁ Automated payment reminders

⦁ Collect payments online/offline

⦁ Automated reconciliation

⦁ Digital inventory management

Visit our SME offerings page: https://hylo.biz/offerings-sme/

Also, give your working capital a boost by availing easy and quick working capital loans at lower rates from our lending partners such as Bajaj Finserv and Neogrowth credit private limited. Get access to real-time cashflows, expense insights, business health, and various other reports, which results in better liquidity and higher operational efficiency.

Read our original blog published here: https://hylo.biz/how-consumer-lending-process-is-experiencing-a-transformation-with-connected-erp-and-connected-banking/

Follow us on medium: https://medium.com/@hylobiz

Are you a business looking to expedite your collections?

Register here: https://hylo.biz/neobank/Login or Book a demo: https://hylo.biz/book-demo/

Read more on Connected banking/ERP: https://hylo.biz/how-connected-erp-accounting-software-can-revolutionize-sme-businesses/

Read more of our blogs: https://hylo.biz/blogs/

Reach us at: support@hylo.biz