The GST council of India has made e-Way Bills a mandate.

Now, what is e-Way Bills? An e-way bill is an electronic waybill.

It is a permit needed for the transportation of goods that are worth more than Rs. 50,000 (applicable for a single invoice/bill/delivery challan) in a vehicle within Indian states.

With the recent introduction of the e-invoicing compliance mandate in the country, the e-way bill generation from IRN has got facilitated.

With the mandates in place, the e-way bill portal had to handle huge traffic for which there were server issues quite often.

Many fraud sites took a chance on hacking sensitive data. This raised worries, and delays, and sometimes caused the cancellation of deliveries.

The technically innovative top SAAS platforms including Hylobiz could solve this and have made compliance easy, efficient, and effective.

Before we tell you how to generate e way bill easily, we would like to clarify some questions on e way bill that you might have in mind.

Here we go.

Why e-way bill?

To comply with GST law, to track and ensure hassle-free movement of goods, and to control tax evasion.

What are the Benefits of the e-Way Bills?

- No need for physical documents.

- Reduction in cost.

- Easy to generate, access, and use.

Who needs an e-way bill?

Every GST registered person who may be a consignor, consignee, recipient, or transporter should generate an e-way bill for transportation by air/rail/road.

An unregistered person supplying goods to the registered person. Here the recipient will have to adhere to compliances and will be considered a supplier.

The transporter should generate an e-way bill if the consignor and the consignee do not generate an e-way bill for the movement of goods above INR 50000.

What is E-way Bill Number?

Eway Bill Number (EBN) is a number that is allocated while e-way bill generation.

What is the Minimum Distance for an e-way bill?

Eway bill is mandatory when the distance to be covered is 50Kms or more.

How long is an e-way bill valid?

For less than 100Kms distances, the e-way bill remains valid for 1 day (24 hours). For every additional 100 kms, the e-way bill validity increases by a day.

What are the components of the e-way bill?

An eway bill is divided into Part A and Part B and contains details of the goods along with the details of the consignor, the recipient, and the transporter.

What will happen if e-Way Bills is not Generated?

The concerned will be penalized by Rs 10000, and goods might also get confiscated.

So generating e-Way bill is a must and we would tell you the process.

Is it Easy to Generate e-Way Bills?

Absolutely yes with the safe and secured Hylobiz platform.

Curious to know about us? We are an ISO-certified Fintech startup supporting the B2B funnel with complete digitization and automation of essential processes in businesses across industries and across verticals.

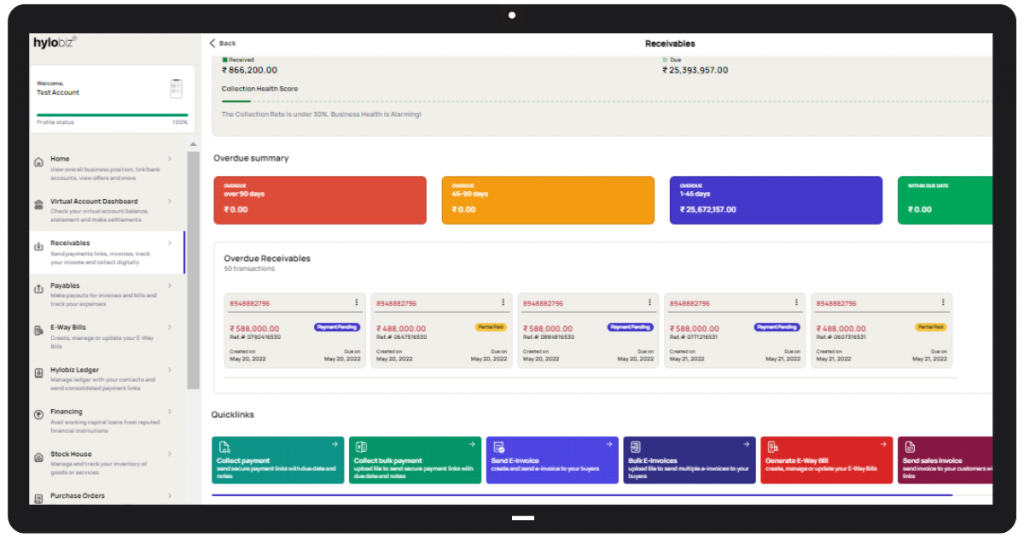

The all-in-one solution can boost payment collections with automated invoices, payment reminders, and payment links.

The smart dashboard and automated reconciliation and reports can help you with all necessary business insights and give you access to complete cash flow visibility.

We ensure the lowest setup time and zero-second downtime. The platform is easy to use.

Read our Blogs Here to know more about us.

How to Generate e-Way Bills on Hylobiz?

- You can integrate your existing ERP and bank account on Hylobiz. The invoices from existing ERP get auto-synced.

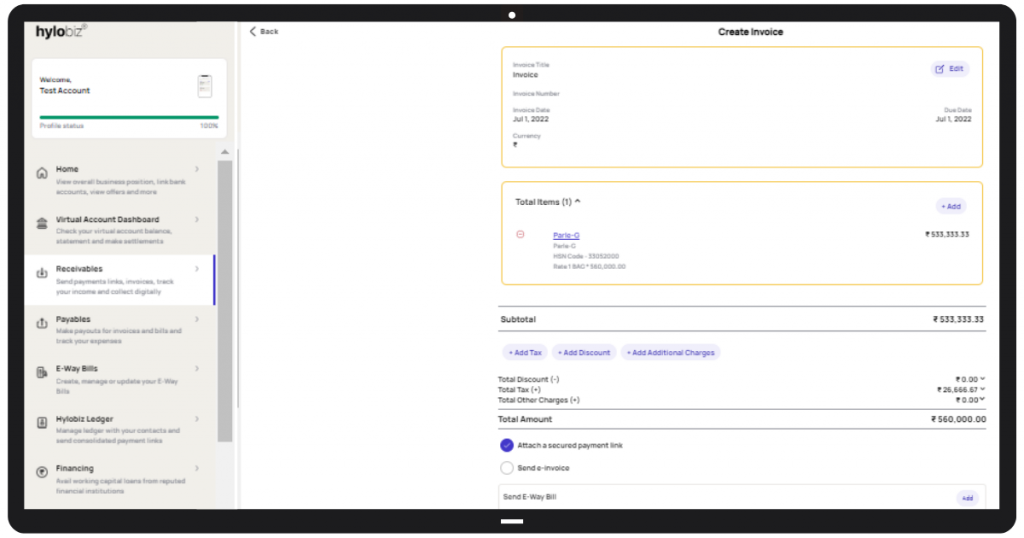

You can also create sales/proforma/ e-Invoicing in simple steps with the help of professional templates for the same. Hylobiz einvoicing solution is powered by Vayana GSP.

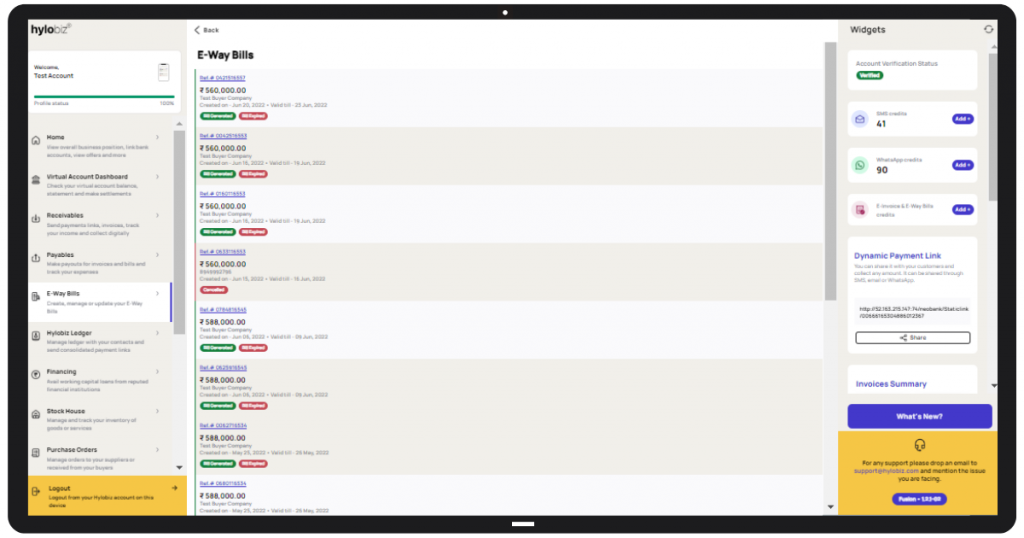

You can generate e Way Bill easily using the previously generated invoices/ e-invoices using our receivables feature.

In this case, the e-Way bill will be auto-filled with invoice/ einvoice data and there is a need to update only transporter details.

- By using the Generate e Way Bill Flow as provided on the platform in the receivables feature. It is also included in the einvoice/ sales invoice flow.

The flow of e-Way Bills Generation:

- You need to select the buyer from the contact list and create invoices and add billing and shipping addresses, then select the item.

- You need to fill up Part A (invoice details) and Part B (vehicle details) in eway bill details.

You can compute the approximate distance between the place of dispatch and delivery with the help of Distance Calculator provided on the platform. - Hylobiz enables you to login to the EWB portal with Eway Bill GST credentials. Once the process is successful, you will get Eway Bill and Invoice/Einvoice number for your reference.

- You can share the invoices and eway bills with concerned parties through multiple channels like WhatsApp/SMS/Email/social channels.

More e-Way Bills functionalities on Hylobiz one-stop

- Update E Way Bill – Update transporter and vehicle details

- Extend Validity of e-Way Bill – The user can extend the validity of e way bill in case of any reasons.

- Smart Dashboard – Track the status of the e-Way Bill on the dashboard and utilize various actions as per requirements with ease (edited).

- Avail of the Printed e-Way Bill: Users can also print the e-Way bill (EWB) from the platform.

- Avail multiple functionalities: The user can consolidate multiple e-way bills, and send them in one vehicle. It is possible to extend the validity of e way bill and update the bill as per the requirement.

Hope we could give a clear picture of e-Way bills basics and its generation process. The platform is user-friendly, transparent, and reliable.

Try Hylobiz to experience the essence of business process automation.

If we did not answer your question, or if there is anything you wish to share, please email us at support@hylo.biz.

If you are looking for a demo to have a virtual experience of the platform, make sure you book a demo. Our experts will guide you.

We are bridging and automating financial services. Need your support to grow a well-knit B2B value chain.

Start Hylobizing and be a part of Hylobiz network. Sign up now.

| Suggested Reads: |

We spoke on multiple GSTIN, eway bill, debit and credit notes, settlement APIs, Hylobiz free offers and more on our latest product update blog: Read it here https://hylo.biz/hylobiz-product-update/ |

Want to know how to get access to collateral free loans? Read https://hylo.biz/collateral-free-loans-for-small-businesses/ |

Women entrepreneurs starting small businesses need to read https://hylo.biz/6-tips-for-women-entrepreneurs-starting-small-businesses/ to know about essential business tips and special Hylobiz offer for women. |