In this ever-changing business environment, the e-invoice system was a game-changer move by the government of India to bring all businesses under the GST e-invoicing in India. In the long run.

e-Invoicing will promote standardization and the smooth functioning of businesses.

An electronic invoice or e-invoice is a system under which a registered taxpayer generates invoices in a standard format(Known as Schema)

Gets authenticated from IRP (Invoice Registration Portal), and receives e-invoices with IRP and QR code.

Under GST, a digital invoice is not considered an e-invoice unless it has an IRN (Invoice reference number) and QR code.

e-Invoice applicability

Firstly e-invoicing was made mandatory for businesses with a turnover of more than Rs500 crores effective from 1st October 2020.

And from the 1st of April 2022, e-invoicing was made applicable to businesses having a turnover of more than Rs20 crores in the preceding financial year.

Also, the government has exempted the following category of persons from e-invoice, some of them are banking companies, NBFC, Financial institutions, Goods transporting agencies, and a few others.

Read more on e-invoicing: https://hylo.biz/what-is-e-invoicing-under-gst/

Why was the e-Invoicing system Introduced?

It was introduced by the government to curb tax evasion and to enable a faster claim of Input tax credit (ITC) for eligible taxpayers.

Also, it allows real-time tracking of invoices and reduces compliance for businesses with savings in cost and improved business efficiency.

The government has granted exemption from e-invoicing to Banking companies, NBFC, Financial institutions, Goods transporting agencies, and others.

How to Generate e-Invoice in GST?

You can easily generate an e-invoice through different available modes such as:

- Web-based

- GST Suvidha Providers (GSPs)/API based

- Mobile app

- Offline

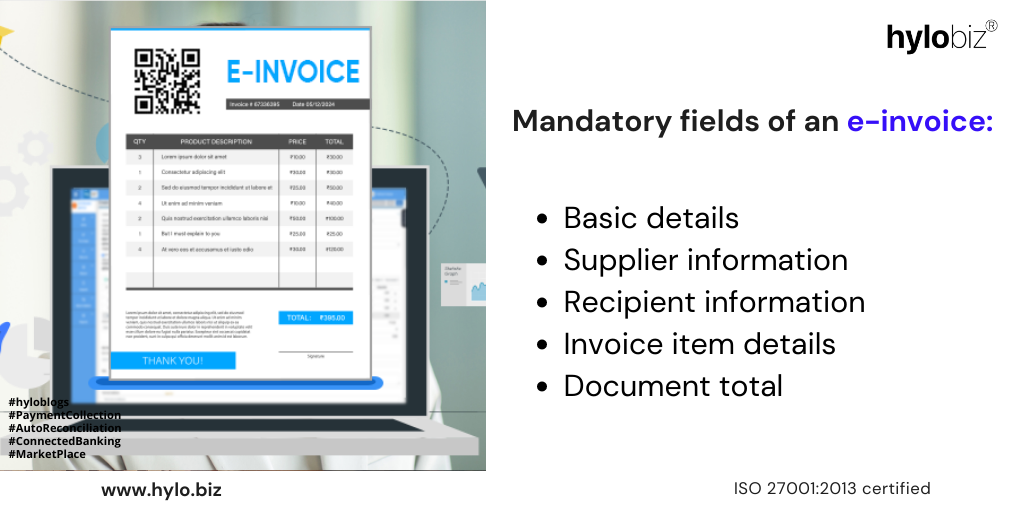

Contents of an e-Invoice

An e-invoice contains two fields, one mandatory and the other optional.

The mandatory fields include basic details, supplier and recipient information, invoice item details, and document total.

Hylobiz is a B2B fintech helping businesses with invoicing, collections, business loans, and cash flows.

Hylobiz helps businesses with its easy-to-use complete e-invoicing solution with many more value-added features.

Benefits of Using Hylobiz as Your e-Invoicing Partner

- Easy, quick, and simple

Hylobiz allows businesses quickly generate e-invoices on its platform in a few easy steps. You can also get an e-invoice by uploading a simple invoice.

- Integrated with ERP

We offer you to integrate your ERP with our systems in the lowest possible time without any process change.

- Zero unscheduled downtime

With We generate single/bulk invoices with zero-second downtime. Hylobiz’s e-invoicing solution is powered by India’s largest GSP – Vayana GSP.

- Connected banking

Also, connect your existing bank accounts on our platform and enjoy an improved flow of collection and vendor payouts.

- Auto reconciliation

With Hylobiz, say bye to manual reconciliation and save your accountant’s time. We offer automatic reconciliation directly into your ERP, which gives you access to the real-time cash flows of your business.

- 360-degree customer support

Avail of round-the-clock support from our technical and domain experts.

Conclusion

E-invoicing helps reduce manual errors, fake invoices, and fake ITC claims. It also enables real-time invoice tracking, eases compliance, and improves overall business processes.

Wait there is much more that you get with Hylobiz.

Let’s Discuss Other Top Features of Hylobiz:

Hylobiz gives you 360-degree control of your business with its smart dashboard, where you can track your business health and get insights into your business expenses.

We help you improve your business collections with automated payment reminders, and also share invoices with attached payment links with your customers and across your social media.

Improve your relationship with your supplier by automating your vendor payouts.

Get a shareable digital ledger for all your transactions that supports auto reconciliation. Also, avail easy and quick business loans from our lending partners at lower rates and fuel your business growth.

Hylobiz is an ISO-certified organization and maintains bank-grade security. All your transactions on our platform are safe and secure with multiple-layer encryptions.

The Hylobiz platform helps you become e-invoicing compliant, helps improve your business collections, and boosts your business cashflows.

Read more about our offerings: https://hylo.biz/offerings-sme/

Follow us on Medium: https://hylobiz.medium.com/

Boost your invoice collections, book a demo today: https://hylo.biz/book-demo/

Suggested read: https://hylo.biz/e-invoicing-benefits-corporate-businesses/

Reach us at: support@hylobiz.com

Frequently Asked Questions

What is e-invoice system?

The Goods and Services Tax (GST) in India has mandated B2B businesses with a turnover of more than Rs 10 crore to generate e-invoices for their customers. An E-invoice system is a system where business-to-business (B2B) invoices are digitally prepared in a specific organized format and authenticated by the GSTN.

What are the benefits of e-invoice compliance to SMEs?

GST einvoice system helps businesses to digitalize and streamline their invoicing process, enabling them to generate & send invoices quickly and easily. Complying with this, helps them to save time, money, and resources by reducing the manual effort required for invoice processing. Businesses can track payments, reduce transaction costs and make their invoicing process more efficient and error-free.

what is e-Invoice applicability?

If you are a business with an annual turnover exceeding 10 crores in the preceding financial year, e-invoice will be applicable, and you need to generate and electronically upload all B2B invoices to the IRP portal in an organized format.

What are the mandatory details required for an e-invoice?

1. Basic details.

2. Suppliers’ information.

3. Buyers’ details.

4. Invoice item details.

5. Documents total.