The rapid growth and development of technology have led human civilization towards a new digital dimension. Neobanks or digital banks are no longer a theory but have evolved to support our daily life.

Following this phenomenon, the traditional banks are facing new challenges almost on a regular routine. They are trying their level best to recreate customer experience for their retainment. Traditional banks also have online services but they majorly focus on their physical branches. Whereas, neobanks such as Hylobiz, Jupiter, Fi Money, Niyo, etc. are fintech platforms.

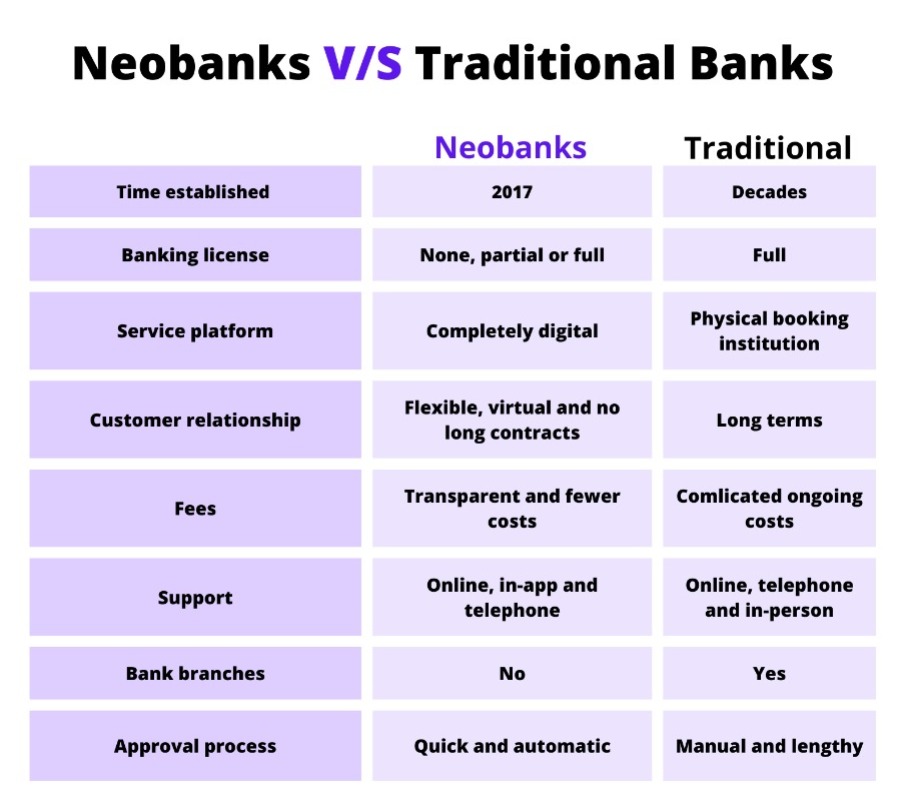

Let us discuss further comparing neobanks to traditional banks and find out which one of them has the potential to dominate the near future, its possibilities, and its drawbacks.

Fintech startups are disrupting the existing services by focusing on user experience, extracting data, decreasing costs, and increasing efficiency with the help of digital offerings.

The services of neobanks are on another level as one doesn’t need to visit the bank to fill up documents or do paperwork. Each and every process is digitized and everything can be done in a snap through a website or a mobile application. This gives the traditional banks a knock on the door to improve their online services, and their risk assessment tools.

Let us map out Neobanks Vs. Traditional Banks:

- Hassle-Free Process Automation.

Neobanks provide online services within a shorter period of time. The software provided here comes up with automated front and back-end processes that keep the operational cost in check but also reduce human error.

Traditional banks work on a cross-channel approach where physical, as well as few online services, are provided keeping the physical branch primary.

- Flexible Payments.

Smart cloud-based systems are used by the neobanks to easily store and manage data whereas, it becomes a challenge for the traditional banks.

Cloud solutions enhance customer assistance and also diminish the risk of data getting stolen.

- Improved Customer Experience.

Neobanks offers a wide range of services to retail as well as small to medium enterprise customers.

As of 2020, approximately 1.9 billion customers globally will actively use different payment software and it is predicted to reach 2.5 billion by 2024. (https://www.statista.com/statistics/1228757/online-banking-users-worldwide/)

- Risky Approach

Traditional banks are considered a little less risky than neobanks.

This factor of differentiation has arisen due to the trust built by the traditional banks for a long period of time. Whereas, neobanks can be considered as new entrants in the market which have a secure integrated system that helps to simplify the businesses.

- Fees and Interest

Neobanks offer lower or fewer fees because of their low overhead costs. This gave traditional banks a competitive state with their fees. So, it’s a win-win for the consumers.

- Attractive to Young Generations

The young generation is more inclined towards the neobanks due to their easy applicability and convenient usage.

Traditional banks seem to be a hustle for young minds as they are not accustomed to rigid systems.

The Future Neobanks Vs. Traditional Banks.

Traditional banks provide a scope of wide services whereas neobanks provide a small range of products and services. Neobanks are still in the process of normalizing themselves throughout the broader sectors of every aspect of our lives.

Traditional banks here gain the upper hand as most of the people of India believe that nothing can beat face-to-face interaction.

The pandemic on the other hand has led to the leverage of cloud-based technologies which have boosted the realm of neobanks.

Traditional banks have started collaborating with the Neobanks where one can avail of the services at one stop. In India, Neobanks are not provided with banking licenses but they provide digital banking facilities with banking partners.

As a result, we can conclude that the growth of the neobanks is tremendous and will not stop in the near future. Nevertheless, there are many threats in playing the long game that can be prevented if steps are taken now. The aim should be to build customer trust and to turn the process into profit.

It is hence a fact the rise of neobanks around the territory of traditional banks has activated the market, expanded the financial involvement, increased the competition, and challenged traditional banks, introducing themselves to the new customer base with new structures and models.

Neobanks for SMEs:

In today’s digitalized era, the rise of neobanks has become popular among SMEs. The majority of them are worried about situations like Covid-19 that sets serious issues regarding their payroll, loan payments, etc. Due to this, businesses are looking for a more reliable solution and are willing to take a step away from the traditional way of banking.

Therefore, neobanks are just the right stop for the problems which the businesses meet.

Hylobiz- one of the top neobanks in India:

Hylobiz is a fast-growing fintech which provides Neobanking services to B2B segments and contributes toward financial inclusiveness. We are currently operating in India and UAE. Unlike traditional banks, Hylobiz in partnership with multiple banks and NBFCs provides financial services to MSMEs and corporations. Hylobiz brings all top business automation and Neobanking features under one roof.

Hylobiz as a neo bank for B2B businesses:

- Digital Lending:

- Collateral free loans in partnership with Neogrowth credit Pvt. Ltd. and Bajaj Finserv

- SME cards

- e-KYC, seamless account creation, and connected banking facilities in alliance with Yes Bank and Kotak Mahindra Bank

Access loan here: (https://app.hylo.biz/login)

- Digital payments and collections through multiple modes

- Automated reconciliation, quick settlement, and automated reports

- Transaction tracking

Read Blog Related to Neobanks: (https://hylo.biz/how-do-neobanks-in-india-works/)

Hylobiz-Other top mentions on features and benefits:

- Automated invoice and inventory management

- E-invoicing ready (https://hylo.biz/e-invoicing/)

- Automated payments and collections

- Payment links

- Automated reminders

- 360-degree support

- ISO Certified

- Zero cost of installation

- AR, AP, and cash flow tracking.

- Automated reports and dashboards.

- Zero-second unscheduled downtime

- Quick onboarding.

- Better tax management and control over audit trials

Catch up on SME offerings: (https://hylo.biz/offerings-sme/)

Hylobiz supports women entrepreneurs:

Special offer for women entrepreneurs:

https://hylo.biz/hylobiz-celebrates-and-supports-women-entrepreneurs-and-professionals/

Read our blogs on: https://hylo.biz/Blogs/

Follow us on Medium: https://hylobiz.medium.com/

Neobanks in India, are the future of the financial sectors which will help in providing working capital efficiency and maintain liquidity in a business. Hylobiz as a fintech platform along with Neobanking services drives 100% customer satisfaction and excellence in terms of business process automation, credit access, taking business decisions, payment collections, and much more.

Email us at: support@hylo.biz

You can contact us here: https://hylo.biz/contactus/