Hylobiz electronically manages the accounting system and automated reconciliation.

The Fintech industry has brought in revolution to the banking and finance industries with the use of innovation and technology. Today recording accounting data and tracking of transactions is not very laborious work. Settlement of payment happens swiftly, and the difficult account reconciliation process can happen automatically if a good Fintech is chosen. All businesses across industries can see good profits if they automated reconciliation the tedious reconciliation process with the help of an effective Fintech.

What is Account reconciliation?

Account reconciliation is all about comparing financial records or transactions to check whether two sets of data are in agreement, to avoid error, and to run a profitable business. The process of balancing the bank statement with the incoming/ outgoing invoices to balance the accounts at the end of an accounting period is called account reconciliation. A more frequent reconciliation if introduced in business can ensure better cash flow and avoid bad debts. A professional in the accounts department is entitled to manage the financial data and transactions and to handle the account reconciliation process.

Why is it important to reconcile?

- To maximise the return on investment,

- To catch fraudulence in business and accounting,

- To detect accounting errors,

- Increases cash flow,

- Saves money.

Challenges involved in manual reconciliation:

- Involves lot of transactions and records across multiple devices, spreadsheets, and documents

- A very tedious and error ridden process

- Labour intensive process demanding long hours of manual work

- Needs sound knowledge and understanding of accounting and business

- High level of patience and diligence required

- Settlement timeframe does not match the rate of transactions done by a business, creating a mismatch

Can you automate bank reconciliation?

Yes, absolutely with the use of correct tools bank reconciliation automation is possible. Auto reconciliation or automated reconciliation is a process where reconciliation happens automatically. The process of comparing the cash account records of your business to the corresponding records on the bank statements can be automated today with technological advances. Auto reconciliation through Excel is very common. Automated bank reconciliation software can accurately automate the account reconciliation process. A Fintech with auto reconciliation and multiple other features does best in this regard.

How do you automate reconciliation process?

Most companies even today reconcile manually. Maintaining excel sheets and documents and manually monitoring invoices/ bills and bank statements as part of the huge reconciliation process involves hours of manual labor across multiple nodes employing many staffs in the responsible department. Hence there is an obvious need for automation of reconciliation. An efficient Fintech like Hylobiz can help you get rid of the difficulties of manual reconciliation. Hylobiz can digitize your accounting process, electronically manage payments and collections, and can automate the reconciliation process with the use of required tools. With Hylobiz the transactions are settled very quickly and get electronically reconciled in real-time in the platform and also with the connected ERP automatically without human intervention once they get posted after processing.

What are the major benefits of electronic reconciliation?

Electronic reconciliation saves paper, reduces cost, and allows the automated reconciliation process. As the transactions involving payment/receipt of bills happen digitally through net banking, debit/ credit cards, or UPI, there is no need to check invoices and spreadsheets manually.

Electronic and automated reconciliation

- Saves time

All outgoing and incoming invoices and the financial record of transactions are compared and matched rapidly, saving a lot of time to utilize in other productive pursuits in business.

- Eliminates error

The chance of human error is just impossible as there is no chance of wrong entry, omission, or deletion. The algorithmic precision achieved through electronic reconciliation can very easily spot mismatch if any.

- Improves visibility and transparency

A clear view of transactions visible to all staff in the concerned department makes the accounting system transparent and enables better planning and better relationship.

- Highly accurate irrespective of the volume of transactions

Whatever may be the volume of transactions, the tracking and recording is highly accurate. If there is an anomaly, it is immediately detected. A wrong transaction may be rectified just very easily.

- Satisfies employees

The tedious process of manual reconciliation when replaced by hassle-free automated reconciliation allows staff to concentrate on analyzing and planning. This brings in staff satisfaction and promotes a better work environment.

- Helps take better decisions

Business-critical decisions can be taken based on consistent tracking and accurate information.

Hylobiz electronically manages the accounting system and automates reconciliation.

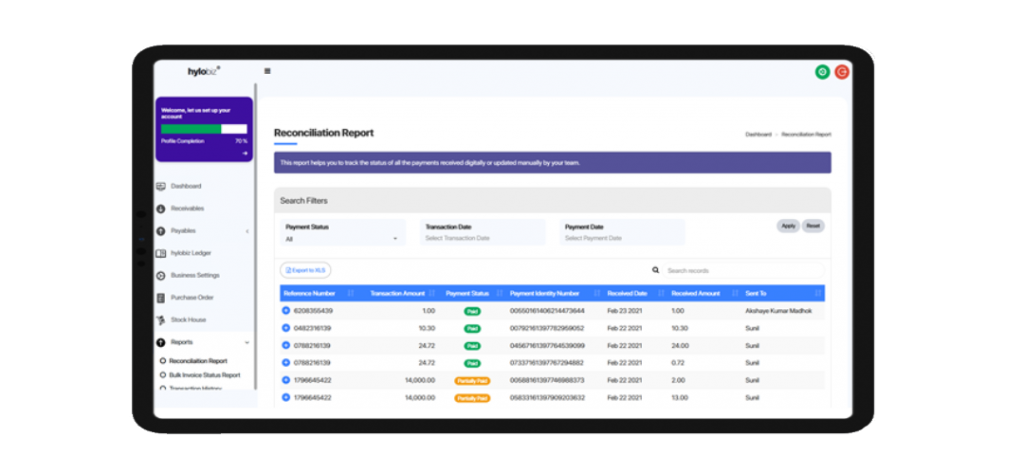

Hylobiz can digitize your accounting system, accurately record finances, can manage and track transactions, manage invoices, pay, and collect payments digitally faster, and reconcile automatically. Some of the other key features on Hylobiz involve digitization of receivables and payables, automated reminders, and quick settlements. Integrate your existing ERP with Hylobiz or upload the transactions using an Excel sheet. A single report of all invoices is generated with a unique payment identification number and you can access the reconciliation report at your convenience.

Automatic electronic reconciliation on Hylobiz: Key points

- money involved reflects on accounts,

- automated realtime reconciliations and daily settlements strongly record financial data and tracks transactions accurately,

- daily settlement and automatic payment transactions report gets populated,

- ability to import structured csv or excel statement files.

Reconciliation is no more a nightmare. Hylobiz auto reconciliation meaning automated reconciliation can help avoid fraudulence and misappropriation of funds and enable hassle-free and faster payment collection.

Want to connect? Do email us at support@hylo.biz.